Share

SME IPOs show potential for long-term value despite regulatory concerns. ETMarkets’ analysis reveals that 55 out of 105 IPOs from the past year delivered multi bagger returns, with an average appreciation of 373%. Analysts stress the importance of fundamental analysis amid high returns and regulatory scrutiny. The hype around the SME IPO market and the resultant caution from the regulator and market veterans kick-started an important debate about the long-term value of these companies. The heightened scrutiny, driven by concerns over inflated valuations and speculative investor behavior, has brought some checks into the market. However, the key question is – are SME IPOs merely vehicles for quick gains, or do they offer sustainable, long-term returns for investors? To make some sense of this, ETMarkets analyzed the performance of SME IPOs, that have hit the markets between September 2022 and September 2023, to gauge their returns over a one to two years period.

Out of 105 SMEs for which the data is available during this period, as many as 55 companies have delivered multi bagger returns to investors from the issue price. Among these IPOs, the average price appreciation is 373%, with the highest gain as high as 2,400%. Meanwhile, at least 7 IPOs have surged over 1,000% over the one to two years period. About 39 IPOs during this period have offered returns below 50% with the least return at -96%. These numbers challenge the widely held belief that investors are solely chasing quick gains, suggesting that SME IPOs have the potential to offer long-term value to investors.

“For SME companies backed by experienced founders and robust business models, the potential for sustained growth is especially promising,” said Narinder Wadhwa, Managing Director and CEO of SKI Capital. Meanwhile, Kresha Gupta, Founder and Director at Step Trade Share Services points out that the appeal of long-term investment in SMEs should not be driven by previous returns, but the focus should be company fundamentals, market positioning, and growth potential. The SME market has come under a lot of scrutiny among market participants in the recent past with some of them questioning the bumper subscription numbers for relatively underperforming business models. So far this year, over 25 SME offers have received subscriptions of 500 times or more and the number goes even higher, if we take into consideration 200x subscription response. Meanwhile, others urged caution about casting doubts on the entire market. For instance, market veteran Ashish Kacholia said many are taking a sledgehammer to the entire SME ecosystem, just because a few companies have gone rogue. The market veteran had echoed a view that regulators shouldn’t throw the baby out and throttle fresh capital issues, but instead encourage investors to do proper due diligence through mass advertising campaigns. Among the checks brought by the regulators include a heightened scrutiny of draft papers filed by the SME companies. Exchanges NSE and BSE have also imposed a 90% price cap on listing gains, aimed at curbing excessive first-day returns that may be driven by irrational demand. The caution around the SME market was immediately reflected in the grey market demand for many of the IPOs in the last one month, where at least 10 companies had no GMP prior to the issue opening or in the run up to the listing. The caution around the SME market was immediately reflected in the grey market demand for many of the IPOs in the last one month, where at least 10 companies had no GMP prior to the issue opening or in the run up to the listing.

“However, the high returns in just one to two years suggest that for those willing to invest with due diligence, the potential for outperformance remains strong. Investors should remain aware of risks but not discount the entire segment due to a few concerns,” said Narinder Wadhwa. While there is an element of fear of missing out (FOMO) for the rally in SME stocks even in the longer run, that cannot be the sole reason. Wadhwa says many of these companies have strong fundamentals, reflected in their balance sheets, growth projections, and leadership. “For example, several SME companies reported revenue growth of 30-50% in the last financial year, coupled with profit margins that have steadily improved by 10-20%. These fundamentals, paired with market momentum, are driving the rally, not merely speculative interest,” he adds. “Many investors are eager to participate in these IPOs due to the potential for high returns. However, the primary driver of this rally is the opportunity to invest in emerging small companies with promising order books and growth prospects,” said Kresha Gupta. While selecting SME IPOs, analysts said the catch here is investors should look for participation from DIIs and FIIs, which can signal confidence in the stock. Further, focus on companies with a clear purpose for raising funds, particularly those aimed at business expansion, which may indicate potential growth and improved fundamentals in the future.

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- Here are 12 Business Founders to keep an eye on in 2025:

- New Passport update: Adding spouse’s name to passport no longer needs marriage certificate, says MEA- Details here

- Indian start-ups are chasing ‘brain-dead’ ideas, says Vivek Wadhwa; urges entrepreneurs to tackle problems with smart tech:

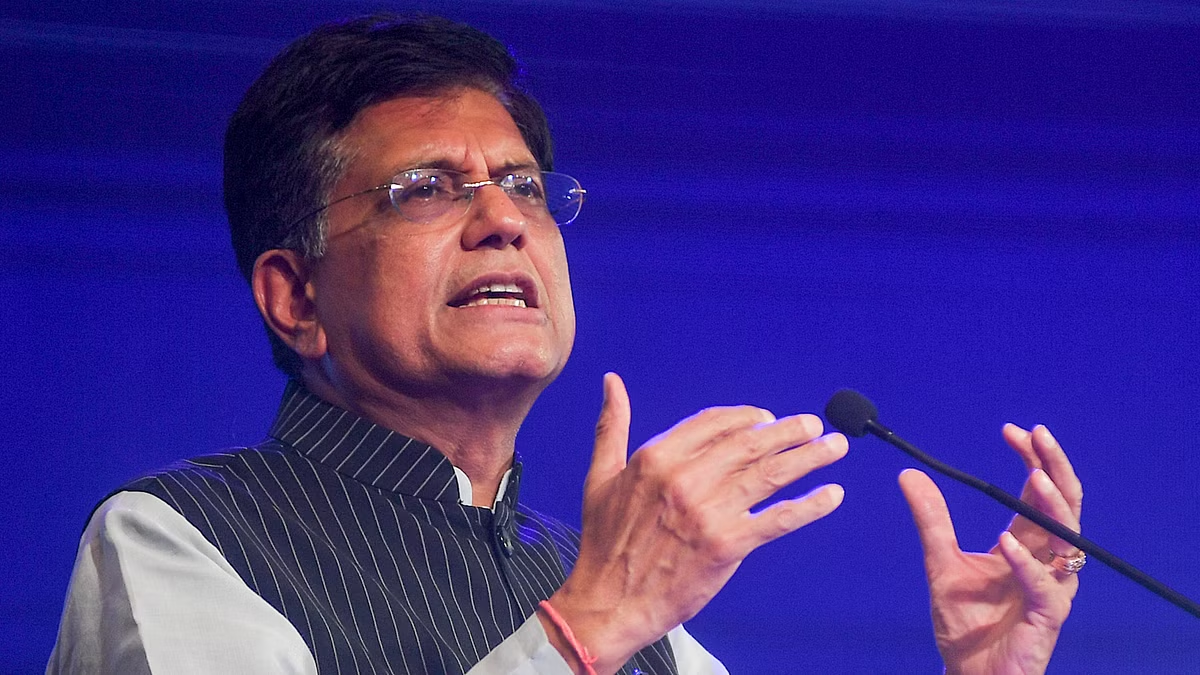

- Mohandas Pai bashed me for my appeals for start-ups to focus on innovation; it is unfortunate: Piyush Goyal:

- TReDS: Govt. reduces turnover threshold to Rs.250 crores to get more companies on invoice discounting platform: