Share

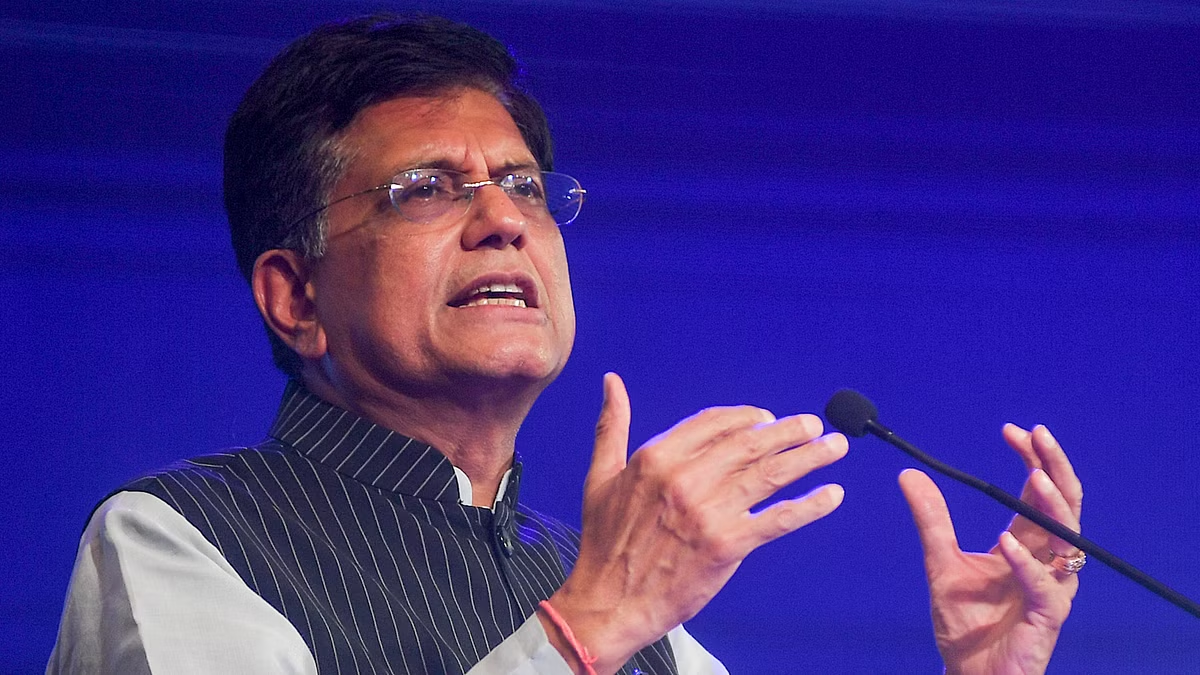

For Indian manufacturers, tie-ups with Chinese firms are crucial at this stage to develop a resilient world-class supply chain before striking out on their own, S Krishnan has said. India must substantially increase electronics exports to remain competitive in the global value chain, as domestic production alone won’t be enough, S Krishnan, secretary of the Ministry of Electronics and Information Technology (MeitY), has said. The next phase of growth will be driven by electronics component manufacturing, expected to contribute $150 billion towards India’s ambitious $500 billion revenue target for the industry, Krishan said in an interview to Moneycontrol. Edited excerpts:

What are the key priority areas for MeitY?

MeitY’s primary focus areas for 2025 revolve around several key initiatives. First and foremost, ensuring the successful implementation of the PLI scheme for IT hardware manufacturer. The Ministry aims to execute all projects initiated under ISM (India Semiconductor Mission) effectively. Another major focus is driving the AI mission forward to ensure its substantial progress. Additionally, efforts will be directed toward launching both the components scheme and ISM 2.0, laying the groundwork for future advancements in these areas. Lastly, properly executing the Digital Personal Data Protection (DPDP) rules requires continuous monitoring and assessment.

How do you view India’s target of $500 billion revenue for the electronics industry?

It’s ambitious but necessary. India accounts for only 2-3% of global electronics manufacturing, which must rise. Out of the $500 billion target, $350 billion is expected from finished products, while $150 billion will come from components. If the Government supports an industry, it cannot be solely based on subsidies or tariff protection — it must be globally competitive. Otherwise, there is no justification for its existence. Why should Indian consumers be forced to buy inferior products? They deserve the best available options. This means that when we manufacture components, we should not only cater to domestic needs but also be capable of exporting them. Competitiveness is best demonstrated through the ability to export. Additionally, since this is a global value chain, exports are essential for long-term sustainability.

Domestic electronics manufacturers have not been able to meet PLI targets:

Current production meets local market demand. In the mobile phone segment, increasing exports is crucial. Exports are rising but today, they are primarily dominated by one or two companies. Chinese companies handle most of the manufacturing, so these companies need to start focusing on exports.

There is demand for a PLI 2.0 for smartphone production. Is that on the cards?

It’s too early to say. There is still some time before a decision is made.

How do you see Chinese brands partnering with Indian EMS brands? How will it help the local ecosystem become more competitive?

It’s essential to understand how the Chinese industry developed. One manufacturing cycle started there, leading to technological learning and skill acquisition. Over time, these companies built upon that foundation. Similarly, India should initially benefit from this process —manufacturing for others, gaining technological expertise, and eventually moving toward independent design and production.

How do you view the capacity expansion by Indian players such as Tata Electronics, Dixon and Bhagwati?

The key point is that electronics has become the largest manufacturing sector. Today, almost every industry relies on multiple electronic devices, making it a mass-consumption product. Previously, this was not the case but now, given India’s large population, it will inevitably become one of the biggest markets. It is crucial to have a strong domestic presence in this segment. While we acknowledge that electronics is part of a global value chain — where components are manufactured across borders— it is important for India to have substantial participation. Without this, we lack resilience. If I manufacture some components that another company needs and vice versa, our interconnectedness strengthens the industry. Therefore, building resilience within the global value chain is essential.

India has extended the import authorization system for laptops and PCs by a year. Why? Will this segment take time before companies start manufacturing in India?

We are closely monitoring this segment. The primary concern is ensuring an uninterrupted supply. Laptops, computers and servers are essential for the tech sector and access must not be hindered. At the same time, we are encouraging domestic manufacturing. Just as the need to import mobile phones has diminished, with the right incentives, the need to import laptops and servers will also decrease. Once domestic manufacturing is well-established, there will be no need to impose restrictions or monitor imports. However, at this stage, we do not want to impose any restrictions that could limit access to these products. Ultimately, Indian consumers must be able to purchase them at internationally competitive prices.

Is there any resistance from large laptop and server companies?

No, there is no resistance. The process requires additional planning, as they need to provide details of their import plans. However, we have not imposed any restrictions. They simply have to submit data, which, while an extra step, is not a significant burden.

If the current legal framework is satisfactory, why do we need a Digital India Act?

We respond to market requirements. As of now, the IT Act remains relevant, and many of its provisions are not yet outdated. The question is whether we need new legislation to address emerging areas like artificial intelligence. Currently, there is no urgent need to legislate AI. At some point, we may need to but not right now. It is more important to focus on innovation and how AI can accelerate economic growth. Regulation should be introduced only when necessary to address risks and concerns posed by AI. Presently, the existing legal framework appears sufficient for most cases. However, the Government remains prepared to legislate if required in the future.

India aims to launch its first homegrown AI foundational model within the next 10 months. What is the update?

We are actively working on it. We have a proper RFP mechanism in place and the teams are already engaged in the project with the required support.

What is the update on ISM 2.0?

We are working on it. Given the scale of the initiative, ISM 2.0 is essential.

Source : https://www.moneycontrol.com/technology/electronics-industry-must-export-more-for-global-competitiveness-meity-secretary-article-12935468.html

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- How low cost of business, entrepreneurial mindset are helping MSMEs thrive in Coimbatore

- Uday Kotak is worried about India’s young entrepreneurs focusing more on stock and MF trading than on building companies

- Guide to FCRA Registration for NGOs in India

- 3rd in a row: Goods exports shrink 2.4%

- Income Tax Department will send notice for not filing ITR on these 9 transactions