Share

Gujarat is emerging as India’s primary semiconductor centre, with major investments being attracted by policy support, abundant land, power, water resources, and a strong chemical industry. At 920 sq. km—twice the size of Mumbai—Dholera is India’s marquee 21st-century urban experiment. Lying along the Delhi-Mumbai Industrial Corridor (DMIC), which will link India’s political capital Delhi with its economic capital Mumbai, Dholera is in reckoning for the country’s first semiconductor fabrication facility (fab). At the forefront of this transformation is Tata Electronics, collaborating with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC) to build a mega fab in Dholera. The fab construction is underway and is expected to be ready by 2026. With an investment of Rs 91,000 crores, India’s first AI-enabled state-of-the-art fab will boast a production capacity of 50,000 wafers per month. Up north, the once-sleepy town of Sanand, on the outskirts of Ahmedabad, has awakened to a semiconductor frenzy. Following Tata’s announcement of a Nano plant in 2008, Sanand is now buzzing with activity as it prepares to host three assembly and testing plants— known in the industry as ATMP (assembly, testing, marking, and packaging) and OSAT (outsourced semiconductor assembly and testing). American chip giant Micron Technology is investing $2.75 billion to set up an OSAT plant in Sanand, while Murugappa Group’s C G Power is partnering with Japan’s Renesas and Thailand’s Stars Microelectronics to create a top-tier OSAT facility with Rs 7,600 crores investment.

What makes Gujarat a preferred bet?

Dholera and Sanand epitomize Gujarat’s rise as the epicenter of India’s semiconductor revolution. This ascent is driven by several key factors, with policy support being paramount. Gujarat was the first State to unveil its Semiconductor Policy within a year of the Central Government’s announcement of the India Semiconductor Mission (ISM) in 2021. The Gujarat Semiconductor Policy 2022-27 offers substantial additional capital assistance, making it a magnet for semiconductor businesses. “The additional capital assistance from the State Government will be provided at the rate of 40% of capital expenditure (CAPEX) assistance given by the Centre,” reads the policy statement

Bringing Chip to Land

As major Asian chip hubs like Japan and Taiwan grapple with land shortages, Gujarat’s abundant land availability is drawing top players in the semiconductor sector. Stakeholders highlight that Gujarat not only offers superior infrastructure but also boasts lower land prices compared to other regions. In fact, the policy has made a generous provision for the fab project being set up in Dholera Special Investment Region (SIR), by providing 75% subsidy on first 200 acres of land purchase, while there is a 50% subsidy on additional land required for the fab or upstream/downstream projects as approved under Centre’s ISM. The State Government is actively supporting these projects by streamlining the process for companies to identify and secure suitable land—ensuring it is free of encumbrances and well-connected to key logistics and transport networks. Additionally, efforts are underway to simplify land procurement by addressing various hurdles, including Right of Way (RoW) and Change of Land Use (CLU) permissions.

Power Play

Gujarat is not just about space and policy; it’s also about power and water. Power Infrastructure is essential for chip production. Fabrication plants typically see hundreds of manufacturing devices operating around the clock, consuming vast amounts of electricity. The State boasts a robust energy infrastructure, with a total installed capacity of 23,550 MW from conventional sources and an impressive 16,588 MW from renewable energy. With a 44% share of renewables, it has the highest proportion of renewable sources in the energy mix among states in India.” Availability of surplus power is one of the major positives for semiconductor projects. Moreover, Gujarat’s semiconductor policy offers compelling incentives, including a Rs 2 per unit power tariff subsidy for 10 years from the date of commercial operation and a complete exemption from electricity duty.

Watering Silicon

Semiconductor factories are big water users, consuming as much as a city like Hong Kong—home to 7.5 million people, according to an S&P Global report. They need this water for cooling systems and generating electricity, but the real reason for their thirst is that ultrapure water is needed to rinse the residue from silicon chips during the fabrication process. To put it in perspective, a typical chip factory can use up to 10 million gallons of ultrapure water each day—that’s as much as 33,000 U.S. households use in a single day. Creating this ultrapure water requires 1,400 to 1,600 gallons of municipal water for every 1,000 gallons produced. Gujarat is leading the charge in addressing this challenge. The dedicated policy for semiconductors not only ensures access to high-quality potable water but also offers a compelling incentive: a 50% capital subsidy for fab projects that build their own desalination plants. Despite grappling with its own water scarcity—averaging just 1,137 cubic meters of fresh water per person—Gujarat is making significant strides in water security. This progress is largely due to the success of the Narmada water project and the expansion of its desalination infrastructure. A landmark achievement in this regard was the commissioning of India’s first desalination plant at Dahej by the Gujarat Industrial Development Corporation (GIDC) in 2022. Previously, water was supplied via the Narmada Canal at a cost of approximately Rs 48.50 per kilo litre. The new desalination facility has dramatically reduced this cost, providing treated water at a more economical Rs 26 per kilo litre. This not only represents a significant cost-saving for industries but also serves as an assurance for the state’s dedication to addressing the industry’s unique needs.

Dahej’s Chemical Advantage

Specialty chemicals are the unsung heroes of semiconductor manufacturing, performing essential tasks like photoresist removal, material etching, wafer cleaning, semiconductor doping, and material deposition. With nearly 250 specialty gases and chemicals in the mix, these vital components ensure the precise and efficient production of cutting-edge electronics. The presence of a large chemical cluster in Dahej in the south-west coast of Gujarat is one of the major reasons for large ticket semiconductor investments happening in the region. To appreciate its impact, consider this: Gujarat supplies approximately 33 percent of the specialty chemicals required by the semiconductor industry. Strategically located between the industrial cities of Ahmedabad, Barida, Surat and Bharuch, the PCPIR (Petroleum, Chemicals and Petrochemicals Investment Region) at Dahej is the only working PCPIR in India. This is the practical reason why there is a gravitation of large semiconductor investment towards a place where the chemical industry is already there.

Advantage Dholera – Hsinchu template

Dholera’s rise as a semiconductor hub echoes the transformation of Taiwan’s Hsinchu City. Just as the 1,400-hectare Hsinchu Science Park became a magnet for some of the biggest names in chipmaking- Taiwan Semiconductor Manufacturing Co. (TSMC), United Microelectronics Corp., and MediaTek, Dholera appears to be progressing along a similar course. Hsinchu’s dramatic rise from a “monga-bo” (Taiwanese slang for “graveyard”) to the center of Taiwan’s chip industry began when the Taiwanese Government offered enticing incentives like tax breaks and land deals to lure tech companies. Today, this park makes up a sizable part of Taiwan’s economy. Inspired by this success story, Governments around the world are investing heavily to build their semiconductor hubs. The U.S. and Japan, once titans of the chip industry, are now channeling billions into subsidies and fostering new centers in regions such as Arizona, Ohio, and Japan’s Kumamoto prefecture. Back home, the Dholera Semicon City, nestled within the Dholera SIR, is set to become a powerhouse for semiconductor innovation. With its state-of-the-art infrastructure and ample land, it’s a breeze for companies to establish themselves, connect with partners, and tap into a skilled workforce. Adding to its allure, Dholera is gearing up for a new airport, located just 80 km from Ahmedabad Airport, slated to be operational by 2025-26. Connectivity will also see a major boost with the ongoing construction of the 109 km Ahmedabad-Dholera Expressway and a semi-high-speed rail line. Passing through the heart of the Dholera SIR, the expressway will cut the travel time between the two cities to just 40-45 minutes. It’s no surprise that Tata Electronics is eyeing Dholera for two more semiconductor fabs, aiming to boost local chip production and meet global demand in the long run. While the partnership details and timelines for these additional fabs are still in the works, production is anticipated to ramp up in five to seven years, matching the scale of the first facility.

Beyond Today

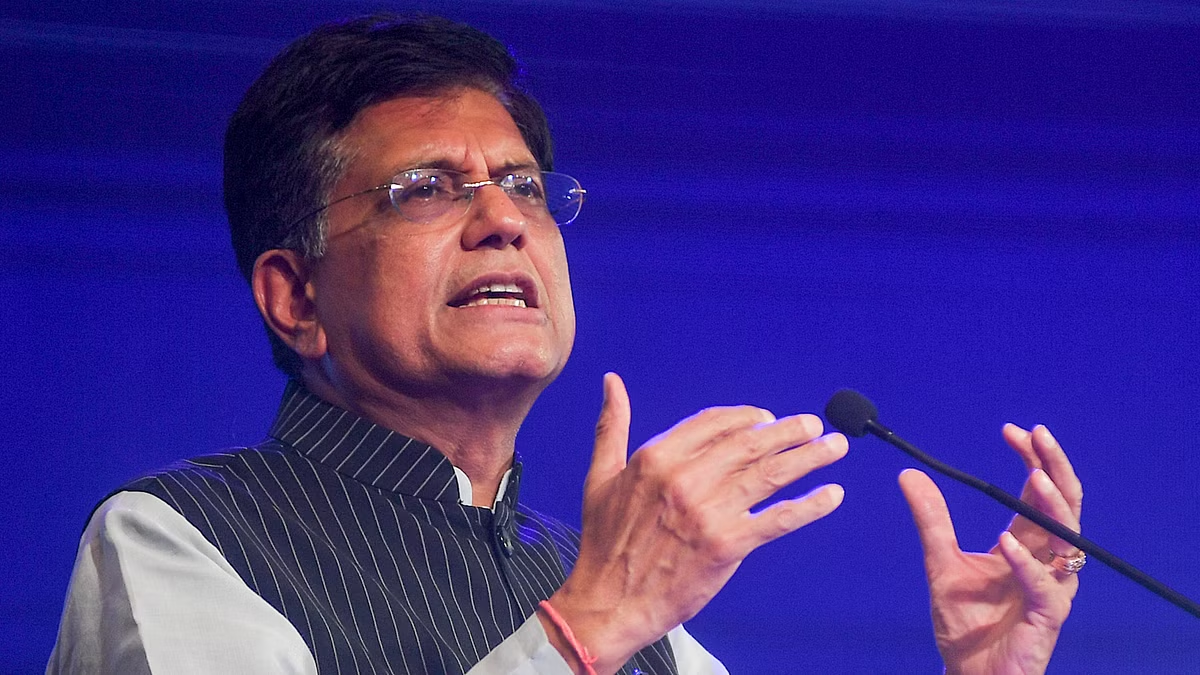

Gujarat’s bold moves to line up enabling policies and sweeteners for semiconductor manufacturing has yielded the first commercial fab proposal. But such a dominance comes with pros and cons. Massive economies of scale have driven down costs, but in this era of decoupling and derisking, other State Governments are getting increasingly uneasy about industry concentration. At the same time, they are also are eager for semiconductor investments from chip makers as they try to revive their manufacturing fortunes. In fact, according to Ashwini Vaishnaw, Union Minister of Railways, Communications and Electronics & Information Technology, at least eight more States are working very seriously now for future projects. While Gujarat has been able to put a robust industrial infrastructure in place, the focus should now shift on two key areas: building a chipmaking equipment industry and addressing chip workforce shortages. For now, getting Micron’s Sanand packaging plant up and running fast is the key as the project could pave the way for other chipmakers to make similar investments.

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- Here are 12 Business Founders to keep an eye on in 2025:

- New Passport update: Adding spouse’s name to passport no longer needs marriage certificate, says MEA- Details here

- Indian start-ups are chasing ‘brain-dead’ ideas, says Vivek Wadhwa; urges entrepreneurs to tackle problems with smart tech:

- Mohandas Pai bashed me for my appeals for start-ups to focus on innovation; it is unfortunate: Piyush Goyal:

- TReDS: Govt. reduces turnover threshold to Rs.250 crores to get more companies on invoice discounting platform: