Share

Focus on certain countries and products has led to increased exports. Can this be sustained?

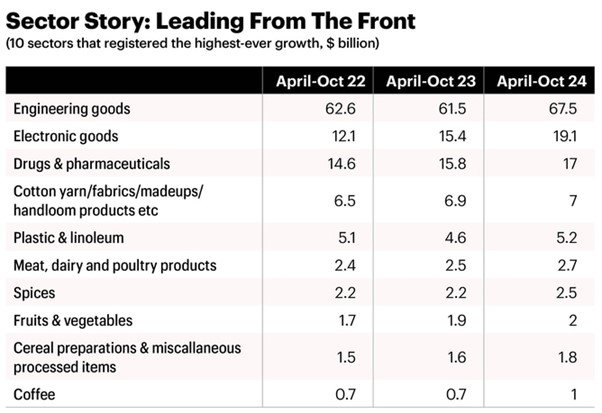

INDIA’S MERCHANDISE foreign trade data for October 2024 came packed with a pleasant surprise. The export value of 10 key products was the highest ever in India’s trade history. Non-petroleum product exports were also at a record $34.61 billion. A beaming Sunil Barthwal, Commerce Secretary, said the October trade performance was not an aberration. “Not only has our overall exports progress been good, we have broken all records in terms of non-petroleum product exports for April-October, too. If we continue in this manner, we are going to cross $800 billion of exports this year.”

While engineering goods export during October rose 39.37% against a year ago, export of electronic goods was up 45.69%, organic and inorganic chemicals 27.35% and labour-intensive readymade garment exports 35%. What made the export performance sweeter was that it came when global merchandise trade is going through a rough patch. World merchandise trade value had fallen 5% and global trade volume contracted 1.2% in 2023. The latest global trade update of UN Trade and Development (UNCTAD) notes global trade in goods has grown at 2% in 2024. UNCTAD also observes that uncertainty looms over 2025 trade outlook, clouded by potential U.S. policy shifts, including broader tariffs that could disrupt global value chains and impact key trading partners. However, despite all these, Indian goods exporters have put up a good show. Barthwal says growth in Indian exports is the result of export-friendly policies and Government interventions. “Our strategy of focusing on certain sectors and countries is perhaps now yielding results. Improved manufacturing competitiveness due to PLI schemes are yielding results,” he says.

Of late, the Commerce Ministry has been focusing on 20 countries of significance, which account for 60% of global imports. It has also identified six focus sectors — engineering goods, electronic goods, chemicals and plastics, drugs and pharmaceuticals, agriculture and allied products and textiles — with 67% share of global imports to boost India’s merchandise exports. Undertaking deeper economic integration in focus countries, improving market access through balanced trade agreements, economic partnerships for investments, promoting ‘Brand India’, addressing non-tariff measures acting as non-tariff barriers etc. are all part of the Centre’s export promotion strategy.

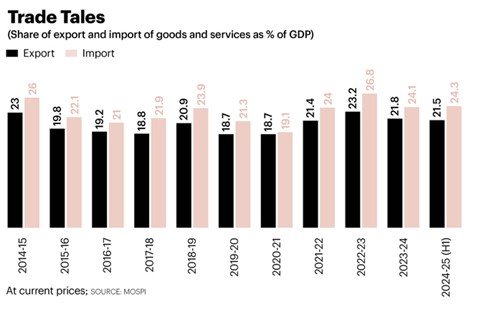

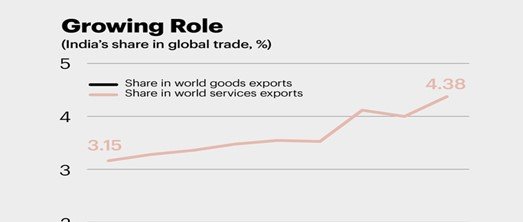

More importantly, India’s services exports have remained strong, even compensating for any weakness in goods exports for years in a row. In fact, it is a global trend. UNCTAD estimates that a 7% rise in services trade has pushed global trade to an all-time high of $33 trillion in 2024. India’s hopes of $800 billion from export of goods and services this fiscal also hinges on growth in services exports. While all these positive signs indicate India’s resilience, the fact remains that the country is still a very marginal player in global trade. In goods exports, India’s share in global trade has grown from 1.69% in 2014 to a mere 1.82% in 2022. In services, the performance has been comparatively better as India’s market share grew from 3.15% in 2014 to 4.38% in 2022, according to the latest data of the Directorate General of Foreign Trade. And if one matches the rise in exports with that of the country’s economic growth, the share of exports in India’s GDP actually fell to 21.8% in 2023-24, from 23% in 2014-15. Unless there is a quantum jump in exports, the overall situation is likely to remain the same. It’s here that Budget 2025-26 becomes important. Supportive policy measures can play a crucial role.

“The biggest challenge before the industry is the availability of credit and cost of credit. We have to augment the flow of credit to export sectors. Despite being categorised under priority sector lending, the value of export credit has come down from about ₹19,000 crores some five years ago to ₹11,700 crores currently,” says Ajay Sahai, director-general and CEO, Federation of Indian Export Organisations. Sahai also points out that the cost of credit in India is very high compared to other countries because the spread of banks is high. “There is a huge difference between lending and deposit rates. We have to have the interest equalisation scheme, to provide some subvention. We expect the government to look into the big picture in the budget — our objective is to take exports to $2 trillion by 2030 — and accordingly provide support to exports.”

In addition to interest equalisation, exporters are looking at budgetary support to reduce logistics cost. “India needs to develop its own shipping line. We should strengthen the Shipping Corp. of India (SCI) if privatisation is not on the cards. If 25-30% of India’s total trade happens through SCI, it will help in reducing the huge remittances. In 2022, we remitted $110 billion on transport freight charges and $80-90 billion of that was shipping charges. If we develop SCI, India will get 30% of the business, we can save $25-30 billion annually,” Sahai explains. Exporters also highlight the need to incentivise research and development (R&D). “Globally, R&D is heavily incentivised. If you look at OECD countries, 34 out of 38 member countries are either providing tax concession or tax deduction. In India, there is no incentive for R&D. There are countries that provide 250-400% tax deduction for R&D expenses. If the budget can provide a tax deduction, companies will be encouraged to invest in R&D, a prerequisite to sustain exports in the long term,” says Sahai.

While new initiatives are welcome, budgetary support to existing schemes can make a big difference as several government initiatives are already attempting to tackle the logistics problem. The National Logistics Policy (NLP), launched in September 2022, talks of boosting India’s economic growth by creating an integrated, efficient, and cost-effective logistics network. The policy aims to reduce logistics costs, improve India’s Logistics Performance Index (LPI) ranking to among the top 25 countries by 2030.

“We know the core problem limiting our export growth. It is lack of competitiveness. We need capital investment, capital spending. And not just on building roads. Road is a low-hanging fruit. Agriculture needs huge amount of investment”, says Biswajit Dhar, distinguished Professor, Council for Social Development, New Delhi. According to him, India has the potential to become a global agriculture export hub. “You are putting less than 6% of your total investment in agriculture. Just imagine if 50% of your horticulture products were not wasted how much of benefits we would have got? We don’t have cold chains, storage facilities, logistics, etc. We are not going in a systematic manner,” says Dhar. India needs to fix a lot of things to see its exporters, as a whole, become globally competitive. But efforts are on. Last year’s Union Budget talked about establishing e-commerce export hubs across India. The first one, a pilot project, will be ready by February 2025. The Government has chosen logistics aggregator Shiprocket and air cargo handling company Cargo Service Centre as the private partners to run the pilots in Delhi. Expedited customs clearance, security clearance, quality inspection and certifications, re-import policies are all being tried out. Once successful, such hubs will come up across India to allow exporters from the hinterland to sell a diverse basket of goods all over the world. In all likelihood, Budget 2025-26 will further strengthen such efforts to help Indian exports.

Source : https://www.fortuneindia.com/long-reads/indias-exports-hit-a-record-high-despite-a-global-trade-slowdown/119899#:~:text=In%20goods%20exports%2C%20India’s%20share,Directorate%20General%20of%20Foreign%20Trade.

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- New Passport update: Adding spouse’s name to passport no longer needs marriage certificate, says MEA- Details here

- Indian start-ups are chasing ‘brain-dead’ ideas, says Vivek Wadhwa; urges entrepreneurs to tackle problems with smart tech:

- Mohandas Pai bashed me for my appeals for start-ups to focus on innovation; it is unfortunate: Piyush Goyal:

- TReDS: Govt. reduces turnover threshold to Rs.250 crores to get more companies on invoice discounting platform:

- Sebi against exuberance, price manipulations in SME listings; Board to discuss it soon: WTM Bhatia