Share

Students should limit their education loans to essential expenses. Banks provide a moratorium on education loan repayments, typically lasting up to a year post-graduation or six months after employment, whichever comes first.

During the moratorium, interest accrues, so servicing the interest can reduce overall costs. Paying extra towards the principal also lowers the total interest.

Before taking a loan, students should check for university-bank partnerships, which may offer lower rates and faster processing.

Borrowing only what’s necessary and avoiding long repayment periods can keep interest payments in check.

« RBI’s Rate Cut Postponement Expected; Third Quarter Adjustment LikelyIRDAI Enforces 3-Hour Time Frame for Processing Cashless Insurance Claims »

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- Here are 12 Business Founders to keep an eye on in 2025:

- New Passport update: Adding spouse’s name to passport no longer needs marriage certificate, says MEA- Details here

- Indian start-ups are chasing ‘brain-dead’ ideas, says Vivek Wadhwa; urges entrepreneurs to tackle problems with smart tech:

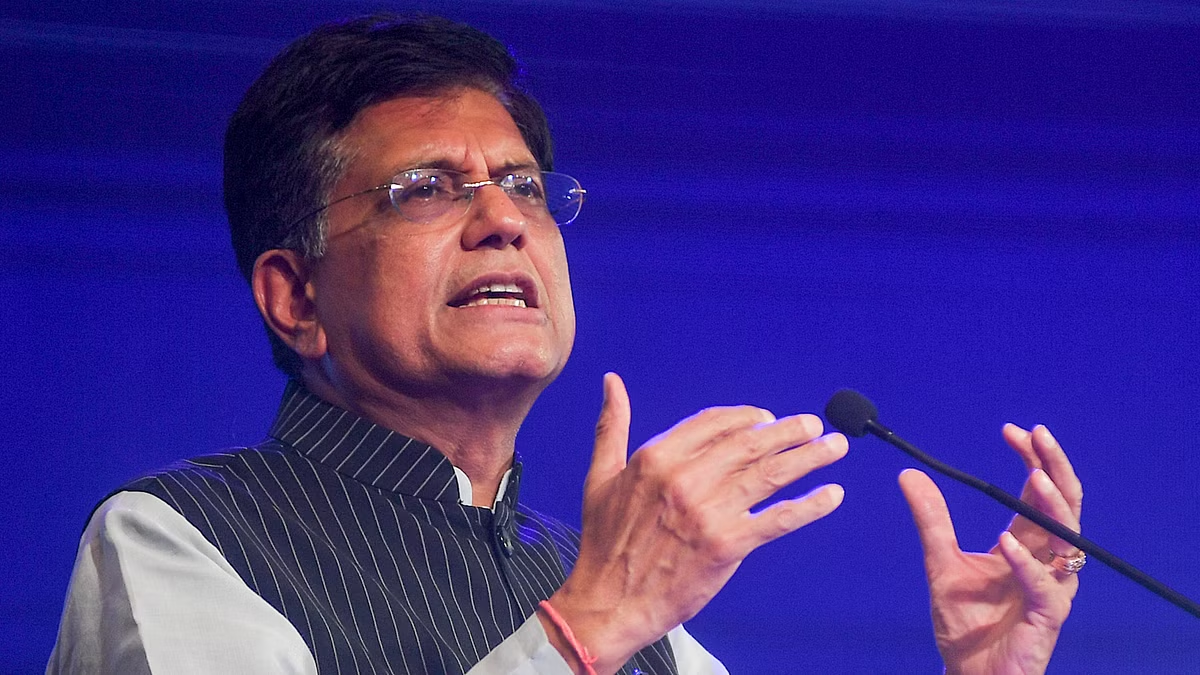

- Mohandas Pai bashed me for my appeals for start-ups to focus on innovation; it is unfortunate: Piyush Goyal:

- TReDS: Govt. reduces turnover threshold to Rs.250 crores to get more companies on invoice discounting platform: