Share

“Exporters can claim benefits under these schemes without obtaining an RCMC,” the DGFT has said in a trade notice. The commerce ministry’s arm DGFT has clarified that registration-cum-membership certificate is not mandatory for exporters to seek benefits under schemes like duty drawback and remission of state levies. According to the Foreign Trade Policy, a Registration-cum-Membership Certificate (RCMC) is required for exporters in order to avail benefits under the policy. Holding the certificate can also help exporters in availing benefits with respect to customs and excise. The certificate is issued by export promotion councils and commodity boards.

The Directorate General of Foreign Trade (DGFT) has said that schemes such as duty drawback, rebate of State and Central taxes and levies and remission of duties and taxes on export products fall under the category of remission-based schemes. These schemes are aimed at remitting duties or taxes on exported goods. For these schemes, “the requirement of an RCMC does not apply. Exporters can claim benefits under these schemes without obtaining an RCMC,” the DGFT has said in a trade notice. In a separate order, the DGFT has clarified that import/ re-import of “Exhibits and Samples” for demo, display, exhibition and participation in fairs or participation in India or abroad shall be regulated under specified norms of the foreign trade policy. They would not be subjected to the requirement of import authorisation or registration under Import Monitoring Systems subject to other compliance.

Related Posts

SEARCH SMECONNECT-DESK

RECENT POST

- Here are 12 Business Founders to keep an eye on in 2025:

- New Passport update: Adding spouse’s name to passport no longer needs marriage certificate, says MEA- Details here

- Indian start-ups are chasing ‘brain-dead’ ideas, says Vivek Wadhwa; urges entrepreneurs to tackle problems with smart tech:

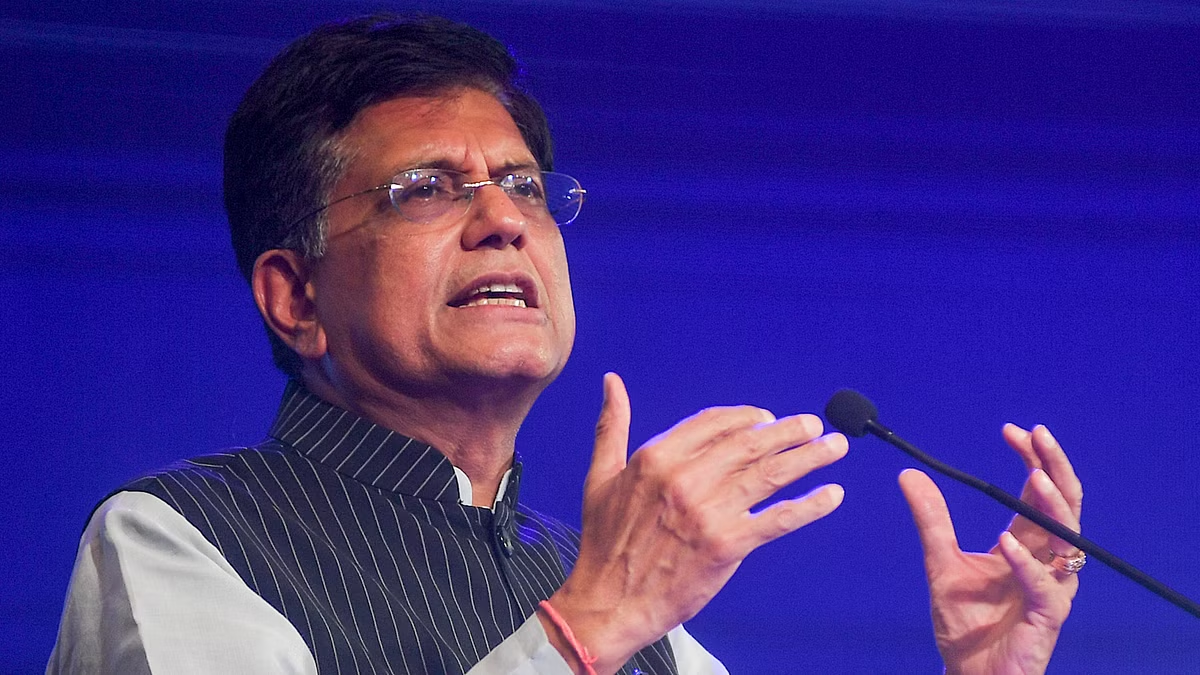

- Mohandas Pai bashed me for my appeals for start-ups to focus on innovation; it is unfortunate: Piyush Goyal:

- TReDS: Govt. reduces turnover threshold to Rs.250 crores to get more companies on invoice discounting platform: