Share

Founded in 2018, Resourceful Automobile operates under the brand name Sawhney Automobile, dealing in Yamaha two-wheelers. The recent Rs.12 crores initial public offering of Resourceful Automobile, a Delhi-based company with just two outlets and a workforce of eight, has taken the market by storm with the issue receiving bids worth close to Rs 4,800 crores. It specializes in the sales and servicing of motorcycles and scooters. The company’s IPO, which was open for subscription from August 22 to 26, saw an overwhelming response, with bids for 40.76 crore shares against the 9.76 lakh shares, on offer translating into a subscription of 419 times on the third day of the bidding process. The SME IPO was subscribed 10.35 times on Day 1 and 74.13 times on Day 2. Overall, the non-institutional investor category subscribed 315.61 times, while retail investors showed even greater enthusiasm, subscribing 496.22 times.

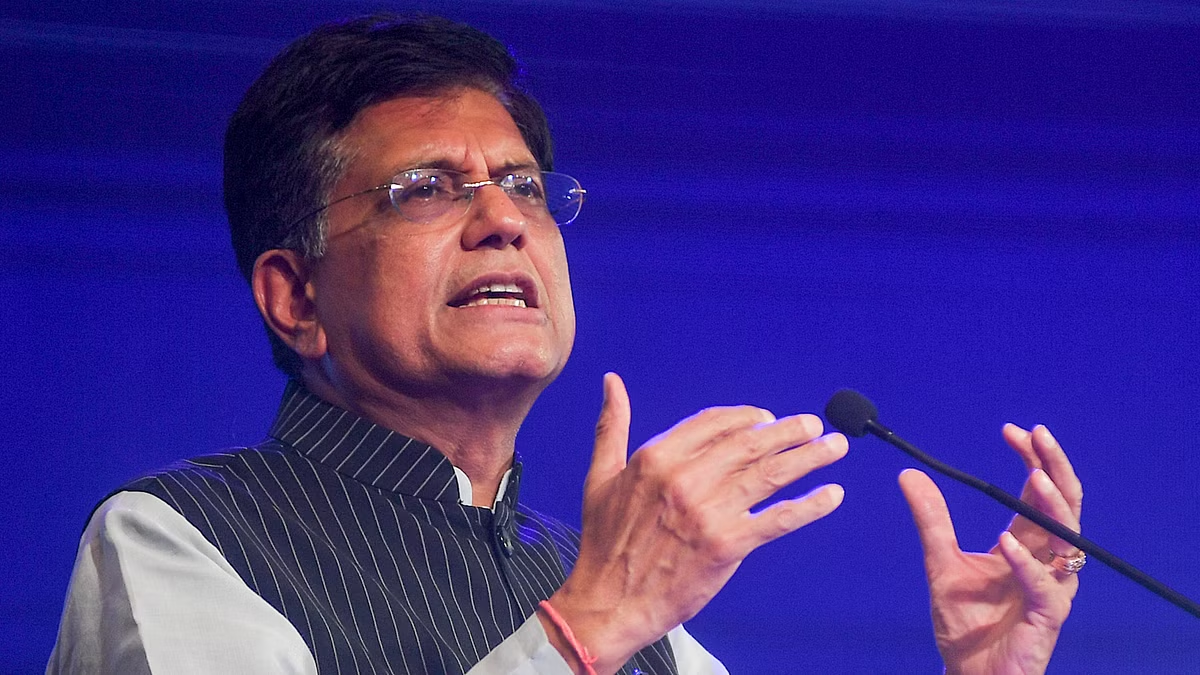

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said that the demand for SME IPOs has become absurd. In anticipation of listing gain, inflow is showering despite the quality of the paper. Oversubscription leads to huge listing appreciation, which continues to rock the stock price as demand remains elevated post-listing. “We can expect such a type of overenthusiasm to vanish over the medium term as the stock market rally consolidates,” he added. This frenzy occurred despite regulators raised concerns about the risks associated with investments in small and medium-sized enterprises (SMEs). On Friday, Sebi’s whole-time member, Ashwani Bhatia, asked chartered accountants to be more diligent, while auditing companies listed on the SME exchange platforms. In March, SEBI Chairperson, Madhabi Puri Buch had flagged concerns around “price manipulation” in the SME platform listings and trading and asked investors to be cautious. Resourceful Automobile’s public issue comprised 10.25 lakh equity shares, priced at Rs 117 each, aggregating to an issue size of Rs 11.99 crores, according to the draft red herring prospectus. The company intends to use the proceeds for expanding its operations by opening new showrooms in Delhi/NCR, repaying debt, meeting incremental working capital requirements and general corporate purposes. The company’s shares are set to be listed on the BSE’s SME platform.